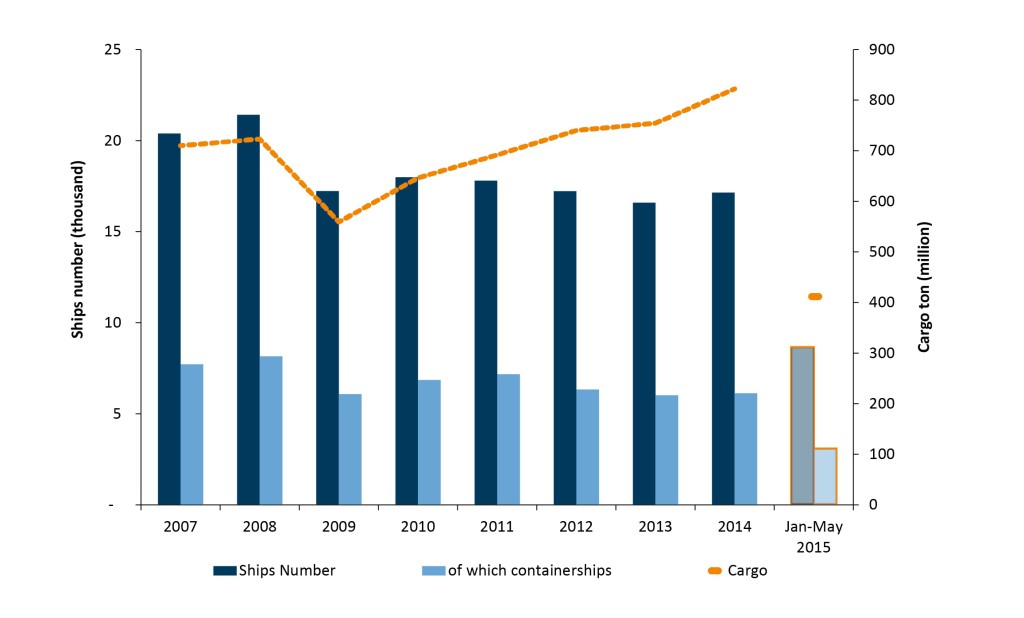

In the last decade, the maritime traffic of the Canal registered significant increments each year, with the exception of the three-year period between 2009 and 2011, increasing by more than 300 million of tons between 2004 and 2014, where it went from around 520 to 822 mn tons. The growth trends and the demand for an increased predictability of crossing times, of growing importance for container traffic – which amounts to more than 50% of the volumes of the market served by the Canal – have led the Egyptian Government to undertake, in a very short time span, an investment of incredible economic and geopolitical magnitude: the doubling of the Canal.

Traffic trends of the Canal

As a consequence, the Suez Canal has become the main communication route between Asia and Europe. Every year, about 7% and 8% of the total of the worldwide exchange of goods transits through the canal [1]. This translates into the movement of 822 million of tons of products in 2014, of which 416 million went from North to South and 406 million from South to North [2].

Container flows have showed an overall growth of 202% from 2000 to 2014, with a difference in the development of the trajectories. In fact, the North-South volumes have increased by 187%, while the South-North ones by 219%, balancing themselves out in 2012 (212 mn tons for North to South and 222 mn tons for the opposite direction). This result can be explained by looking at the operating principles of international trade, characterized by the phenomenon of globalization, and drove by the delocalization of the production toward Countries with low labour cost.

Ships and cargo in the Suez Canal (Source: Suez Canal Authority).

The New Suez Canal

The new canal has increased the transit capacity to 97 ships, compared to a previous average of 49 ships; today, even if the opening was not so long ago, the capacity is already at 70 ships. The renewal of the Canal, inaugurated in the August of 2015 with construction works covering a 72 km route, can allow at the present the simultaneous transit of an increased number of ships, doubling up to 50% the capacity of the previous Canal. The works involved the digging of a new 35 km route alongside the existing one and the widening and deepening of the existing Canal for a 37 km route.

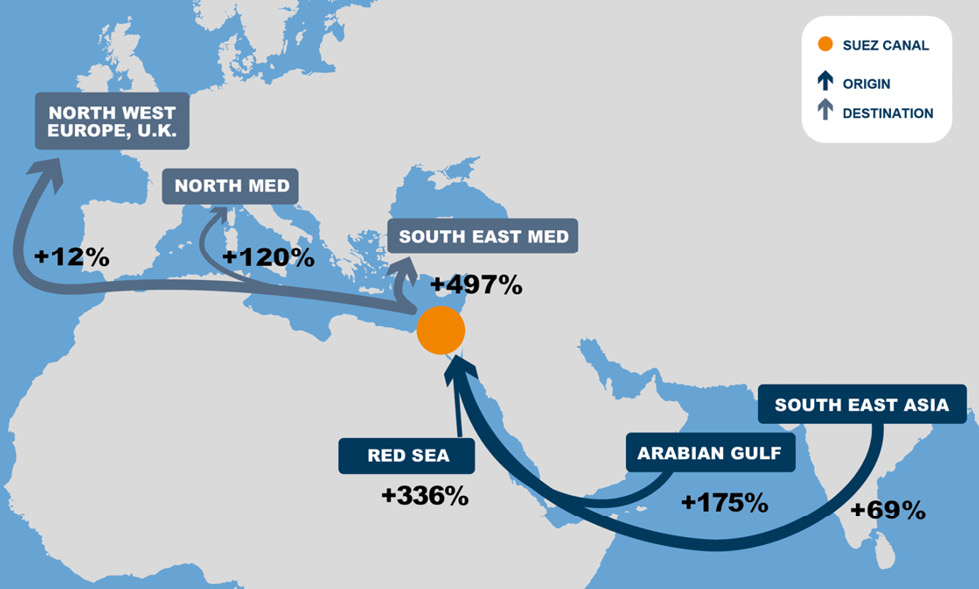

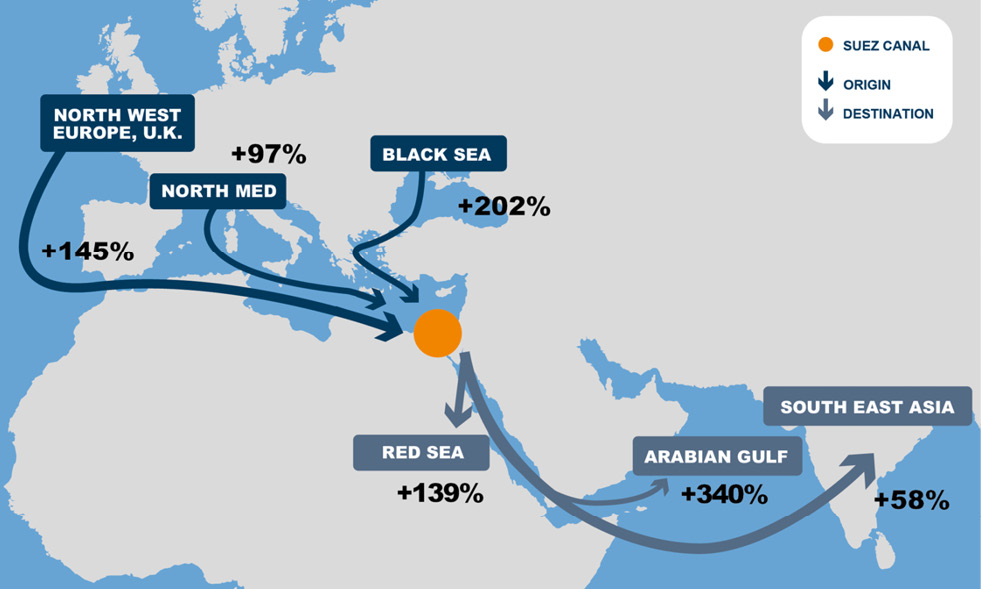

The main North-South cargo* flows of the Suez Canal: % var 2001-2014 (Source: SRM on Suez Canal Authority data. Data available since 2001). * The cargo flows are represented by arrows whose width indicates the absolute value in terms of goods.

The main North-South cargo* flows of the Suez Canal: % var 2001-2014 (Source: SRM on Suez Canal Authority data. Data available since 2001).

* The cargo flows are represented by arrows whose width indicates the absolute value in terms of goods.

The new canal fixes the issues tied to the long waiting times of the ships at the entrance of the Canal and in by-pass points. The estimated average mooring time for the whole process of transiting through the Canal amounts to a maximum of 18 hours. Total navigation time ranges to 12 to 16 hours. The longest possible waiting time can be of 3 hours.

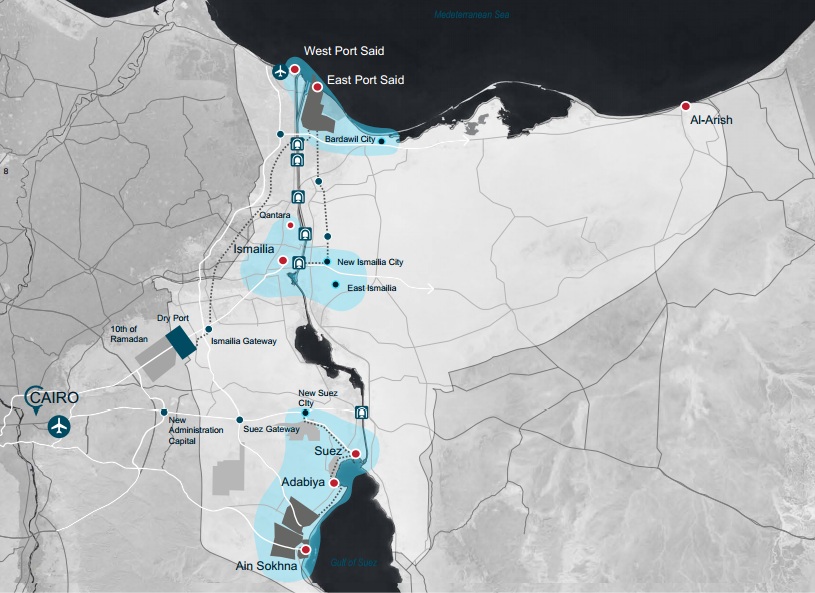

Together with the New Canal, the Egyptian Government has also launched the “Suez Canal Corridor Area Project” (SCZone), a huge investment plan which aims at turning the Canal region into an economic development hub, thanks to the creation of research centres, industrial poles and logistics areas throughout this connecting route between East and West. In this context, the New Canal is merely a necessary requirement, by no means enough to lead to the success of this far more imposing initiative [3].

Expected impacts on maritime traffic

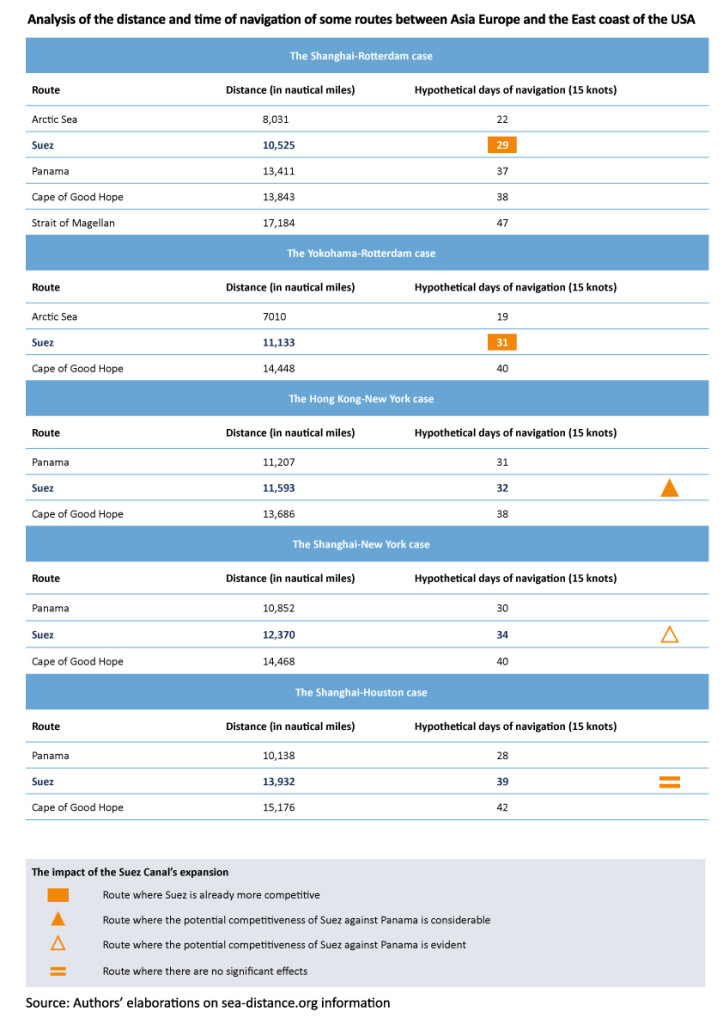

When choosing which routes to cross between Asia and the East Coast of the United States, maritime companies take into account the following strategic elements:

- the possibility of getting the most out of the economies of scale in the consumption of bunkers by using large-sized ships (for example, exceeding the 14.500 TEU limit, the maximum capacity threshold needed to gain access to the new Panama canal, which will be launched in 2016);

- the possibility to direct several routes through the most relevant hubs, of capital importance for the balance of the flows, such as Colombo, Dubai, Port Said, Gioia Tauro, Malta, Algeciras, Tangier;

- the cost of crossing the canals.

A focused analysis of the choices taken by maritime companies offering services dedicated to container traffic on the route between the Far East and the East Cost of the United States carried out by the specialized research company Alphaliner [4] highlights a trend that, while unsteady, saw a decrease in the value of the capacity offered by Panama throughout the last five years, balancing itself almost evenly between the two canals (51% of the traffic of the Far East-East Cost US route goes through Panama and 49% through Suez). This trend changed with the decrease of the cost of the bunkers.

The regional development plan for the Suez Canal (Source: Suez Canal Area Development Project).

A decreased uncertainty regarding the crossing times of the Suez Canal, the strengthening of the local transhipment hubs and the choice of maintaining the same crossing fees of the Suez Canal are the main elements which will be able to decrease the effects of the expanding competition on the routes between Asia and the East Coast US deriving from the planned expansions the Panama canal will undergo in the middle of 2016.

Economic effects

The new canal allows for more reliability of the maritime shipping services on every main route, especially thanks to the reduction of waiting times.

The traffic which will benefit more from the New Canal is going to be the one related to containerships [5], which account for the biggest part of predominant traffic, with a tonnage share greater than 50% of the total, due to the superior value of their goods and the organizational arrangements of services that require the condition of reliability and punctuality in order to match the flows through the hub ports [6].

With the increase of container traffic and the concentration of supply, the leading maritime companies have become increasingly selective when choosing their ports of call. In an environment rampant with “ship gigantism” and growing oligopolies, it is necessary to change one’s approach to logistic organization between port structures, land-based terminals and multimodal corridors.

The ports are also turning into a place filled with industrial activities where one should locate parts of the productive chain with a high added value, which rely on warehouses and services offered by logistic centres.

Analysis of the days and the distances of some of the routes between Asia – Europe – East Cost US (Source: Elaborations on data taken from www.sea-distance.org).

These topics are particularly relevant not only for the arising reality in Egypt, but also because of the gateway ports of North Italy, which receive a relevant share of the traffic through Suez. For example, this value amounts to 51% of the containers moved in Genoa and to 47% of the one transiting by the La Spezia port.

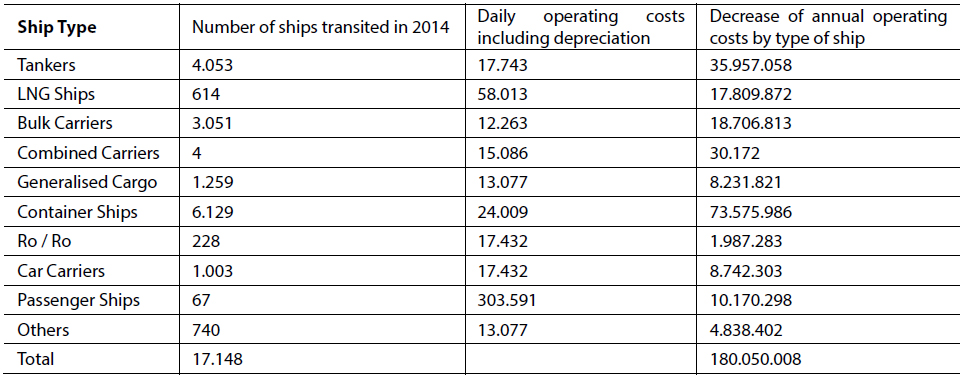

In 2014, 6.129 container ships traversed the Suez Canal, with a total cargo of over 42 million TEU. On average, the cargo shipped by a single vehicle amounted to 6.863 TEU.

The opening of the New Suez Canal will provide greater reliability of maritime shipping services on the main East-West routes between Asia, Europe and the East Cost of the United States. Moreover, a half-day reduction of shipping times is to be expected, due to the improvement of the conditions of navigability of the Canal and the decrease of waiting times, creating an estimated saving of around 10.500 Euro for each ship.

Operating costs by type of ship and estimate of annual savings -figures expressed in Euro (Source: Elaborations on traffic data taken from the 2014 annual report of the Suez Canal Authority and on operating costs taken from the report “Ship Operating Costs Annual review and Forecast”, Annual Report 2014/15, Drewry 2015, with figures expressed in Euro based on the value of the Euro/US$ rate of 1,11 – 10 July 2015 exchange rate).

The estimated decrease of shipping operating costs of 5-10% per ship, along with the increase of the capacity of the Canal, might have important repercussions on the traffic volumes to the advantage of the Suez route. For example, due to the lower transit times of the new Canal, the Hong Kong- New York route might become a valid alternative to Panama.

Expected impacts on Italian ports

The effects on the Italian port network of the new Suez Canal and of the development of Egyptian ports will likely be twofold, according to the competitive position they take in the context of Mediterranean port systems, highlighting new development opportunities for activities focused on import and export flows, which are going to be more substantial in the medium-long term, as well as new threats, which are going to arise especially in the short term, deriving from the increased competition for terminal operators in the transhipment field.

In fact, import-export ports might take advantage especially from:

- lower transit times toward the Red Sea and the Arabian Gulf;

- a decrease of operating costs of the ships (except bunker ones), averaging from 5 to 10%;

- a redrawing of the usual routes (Containers and Ro/Ro) capable of increasing the number of ports reached within the same timeframe of the organizational model of the routes, which is usually of 14, 21 or 28 days.

Significant advantages might thus be provided to maritime companies transiting through the Mediterranean, the Red Sea and the Arabian Gulf routes. The ones which will benefit more from the traffic increase are going to be those adhering to the main alliances of the container sector, which added this trajectory to a wider range of services (for example between the Indian Subcontinent and Southern Europe), as well as to dedicated routes.

Among the companies capable of granting specialized services a relevant role is taken, for example, by the Italian Grimaldi Lines of Napes and the Tarros of La Spezia, which at the current stage call only in the Egyptian ports of the Mediterranean, among the ones available in the whole area.

The main Italian terminal areas dedicated to import-export, Ro-Ro and container traffic are found in Genoa (Terminal Ronco Canepa, managed directly by Ignazio Messina spa), in La Spezia (Gulf Terminal, managed by Tarros), in Salerno with the Salerno Container Terminal Spa (Gruppo Gallozzi) and in Venice (Venice RO- Port-MOS and TIV). In Venice, the entry into force of several important investments related to Ro/Ro traffic allows for relevant growth possibilities. Genoa is also going to be the scenario of some significant infrastructural interventions, although they are going to effectively handle the increase of the traffic expected in the Eastern Mediterranean and the Red Sea only from the end of 2016. Other ports should undertake well-aimed investments in order to avoid congestion issues.

Regarding the cruise sector, the Italian port system of Southern Italy, consisting for the most part by the ports of Naples, Salerno, Bari and Catania, could take direct advantage from the reduction of transit times of the Suez Canal.

Italian transhipment ports might face some threats, especially in the short term. In fact, the expected strengthening of the ports located to the North of the Canal, such as Port Said and Damietta, dedicated to hub & spokes and interlining transhipment traffic, which will be also caused by an expected increase of the regular routes between the Mediterranean and the Red Sea, might divert some of the flows from the Italian ports to the Egyptian ones, repeating what has already happened in the recent past.

Lastly, we have esteemed, with some thoughts and hypothesis of qualitative and quantitative nature, the value, in terms of TEUs, that the ports in South Italy might be able to intercept after the renewal project of the canal will be completed. The analysis took as an example the Far East-East Coast US route, which every year moves around 7,4 million TEU [7].

On the basis of the recent Alphaliner [8] analysis (see the preceding paragraph), 51% of the total capacity of the traffic on this trajectory transits in the Pacific Ocean and the Mexican Gulf through the Panama canal, amounting to 3,79 million TEU, and 49% navigates in the Indian Ocean and the Mediterranean Sea through the Suez Canal, amounting to 3,69 million TEU. Following the hypothesis that the extension of the Suez canal will absorb some of the 16 usual services existing through Panama (a plausible scenario, due to the increased reliability and the reduction of transit times deriving from the renewal of the Egyptian canal), it can be estimated that around 25% of said traffic could transit through Suez, increasing the volumes of the Canal and of the Mediterranean for a value amounting to about 949.000 TEU.

Consequentially, Italy, which owns a 18% market share of transhipment traffic in the MED area (2013 data), could be able to intercept an additional traffic volume, amounting to over 170k TEU.

It should be noted, though, that the number of services and the capacity offered by maritime shipping companies in the container sector are subject to a wide range of variables, since the benefit thresholds (oil costs, renting costs, canal transit fees, etc.) are affected by the perpetual unsteadiness of numerous factors tied to the international economy.

Conclusions

The expansion of the Canal, as data and estimates have showed, will have a relevant impact on ship traffic and trading activities, and will be an unmissable opportunity for businesses and navigation companies, with the former being able to rely on faster delivery times of the goods, leading to an improvement of internationalization processes, and the latter being able to optimize the routes and improve the efficiency of logistics systems.

The new canal, as such, is not only an impressive infrastructural project, but it is also bound to become an economic, trading and logistic hub for the whole of Egypt.

This will also go to the benefit of the relevance of the Mediterranean, an area in which 19% of worldwide goods traffic is already taking place, and whose traffics, in the last 15 years, have increased by over 120%; the area also has been the scenario where important port investments in several Countries of the Basin have happened (Tanger Med, Piraeus, Algesiras and Valencia come to mind).

The number of vessels will likely increase due to the growing presence of large ships and leading players; it’s worth pointing out that the Mediterranean is crossed by ships of the 2M alliance [9] and of the Ocean Three alliance [10]. The presence of Mega Ships and the investments of port competitors should bring Italian ports, especially the Southern Italian Region and transhipment ones, to invest in infrastructures, technology and logistics, if they wish to not lose market shares and to grasp the new opportunities arising from the expansion of the SUEZ canal.

The relaunch of Italy and of the Southern Italian Region must thus go through the rearrangement of the port system, which should be a pivotal point in the development plan of the Country; one should also pay particular attention toward the new traffics the canal could activate in the short, medium and long term, as well as putting into place stronger economic and trading relations with Egypt.

The article is based on “SRM, 2015, The New Suez Canal: economic impact on maritime trade” in cooperation with CERTeT Bocconi.

Notes

[1] World Shipping Council, The Suez Canal – A vital shortcut for global commerce, 2014.

[2] The statistics examined in the following paragraphs have been collected by the Suez Canal Authority and have been made available on the website www.suezcanal.gov.eg

[3] The SCZone project aims to develop three areas of the region with immediate availability of infrastructural spaces; Port Said to the North of the Canal, Qantara (Ismailia) situated halfway between the two accesses and Ain Sokhna, to the South, in the Gulf of Suez.

The heart of the investment plan lies in the will of creating an area capable of competing with the main European and Middle Eastern logistic regions, such as Rotterdam, Hamburg and Jebel Ali, by taking advantage of the centrality of the Canal, an unavoidable pathway for trading traffics between East and West

[4] Alphaliner Weekly newsletter, n°28 of 2015.

[5] As a demonstration of the dynamism of the sector, on the 1st of January 2015, according to Alphaliner data, the capacity of the containership fleet reached 18,37 million TEU, with a 6,3% increase compared to the previous year and an overall growth rate of 162% in the last ten years. Some recent econometric academic studies have proved the existence of a causal link between the increase of the trade among Countries and the diffusion of containers for the shipping of goods. In fact, the increase of the size of ships, the optimization of the number of the ports and of the investments and the growth of productivity of port-related works has made possible to exploit new economies of scale, reducing shipping costs and allowing, as a consequence, to take advantage from localization economies, turning maritime trade into one of the driving forces of globalization.

[6] The decrease of the uncertainty factor linked to the times of maritime shipping has also encouraged the development of international productive chains inspired by a “just in time” productive model, which seek minimization of stocks and exploitation of the advantages coming from the diversification in labour cost and of international productive specializations.

[7] SRM on Alphaliner (2015).

[8] Alphaliner Weekly newsletter, n° 28 of 2015.

[9] (Maersk, MSC).

[10] (CMA CGM, UASC, CSCL).

Head Image: Egypt’s New Suez Canal.